What are financial reports?

Financial reporting refers to standard practices that give stakeholders an accurate depiction of a company’s finances, including their revenues, expenses, profits, capital, and cash flow, as formal records that provide in-depth insights into financial information.

(Read our blog post on Streamlining Financial Reports in NetSuite here.)

Why are financial reports important?

- They are required by law for tax purposes

- Financial reporting and analysis give investors, creditors, and other businesses an idea of the financial integrity and creditworthiness of a company

- Financial reporting software provides crucial information that can be used to make better business decisions

- Financial reports can help with making internal decisions and providing improved internal vision

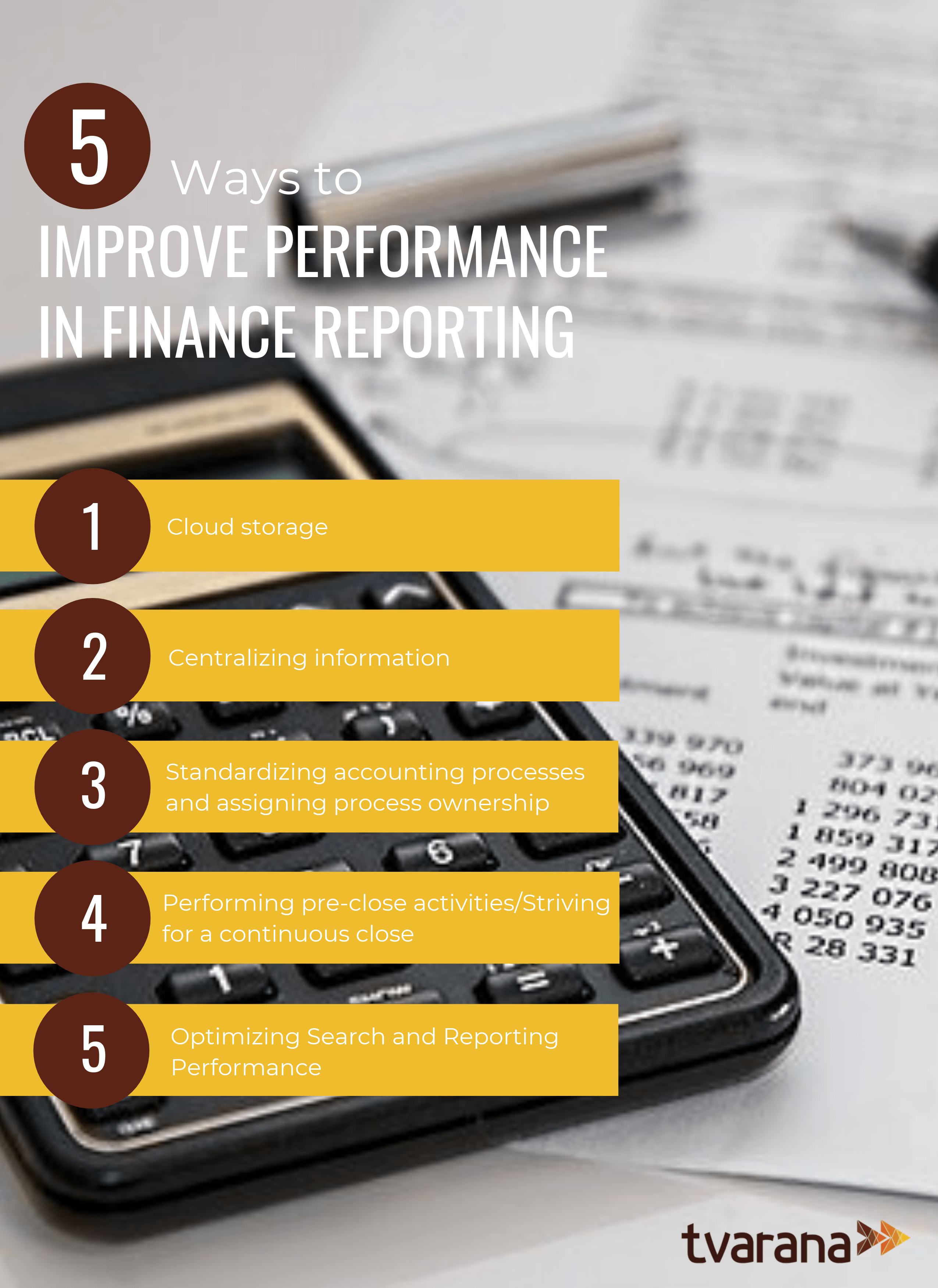

How to improve performance in finance reporting ?

They are several ways in which a company can improve the quality and performance of financial reporting.

Cloud storage:

Cloud storage can be easily implemented for financial reporting. Having information in the cloud means that people can easily share and access documents, as well as work on them concurrently from different locations. This minimises the risk of data loss and people working from previous versions of documents.

(Read our blog on how SkyDoc can help extend storage space on NetSuite using AWS S3 cloud storage here)

Centralizing information:

A critical part of financial management strategy is how the organization elects to structure the delivery of processes in order to best support the needs of the business and other key stakeholders. Strategic financial management involves controlling, allocating, and obtaining a company’s assets and liabilities, while managing finances with a focus on long-term financial success and maximizing shareholder value. Centralizing information is a key piece of a sound financial strategy. It is proven to save money, prevent the duplication of work, and provides a unifying view over the entire organization’s finance activities. Internally centralizing disparate finance functions involves change management, and process automation is essential to reaping the benefits of centralization like increased productivity, visibility and control over financial processes. However, without a robust ERP system in place, change management is virtually impossible. Using dynamic reporting tools, an ERP software like NetSuite indicates where changes need to be made.

(Read our helpful user guide to NetSuite here.)

Standardizing accounting processes and assigning process ownership:

Process standardization is a critical driver of performance, and often a prerequisite to successful automation. End-to-end process management and global process ownership frequently go hand in hand with shared services implementation. Use permissions to limit who can view and edit specific documents, pages, or spreadsheet cells to help preserve data integrity. SkyDoc by Tvarana is an effective tool that can be used to assign ownership, as well as limit access to documents to specific users from within Netsuite. In order to maximize efficiency and accuracy, all of these processes should be standardized across an organization.

Performing pre-close activities/striving for a continuous close:

The month-end close at many organizations is an important activity, frequently involving overtime for finance and accounting professionals, as they are required to manually enter, gather, collate, and analyze data. An efficient month end closing process improves internal control and reduces business risk. Month-end closing process is an accounting procedure undertaken at the end of the month to close out the current posting period.

Make your NetSuite year-end closing a breeze by keeping in mind the tips below:

- Clean data is a clean close. Having clean data by the year end/period end is essential

- A fiscal calendar determines the start date for a fiscal year, and rolls up the accounting periods to build a fiscal year

- Fiscal calendars play a vital role while closing in NetSuite, as fiscal calendars apply to accounting periods and tax periods. The setup of the fiscal year is done using customizable accounting periods for each fiscal calendar, as different countries have different fiscal calendars

- Assigning of fiscal calendars can be done to one or more subsidiaries. Organizing the fiscal calendar across subsidiaries leads to accounting periods being organized automatically, which in turn helps with a clean close

- Keeping the customer and vendor data clean and neat in NetSuite is imperative

- Remove duplicates from customer or vendor records and retain original data

- Balancing of physical inventory with NetSuite inventory and asset records is an important part of year-end closing. A physical count is done by matching physical inventory worksheets to present-date NetSuite records. If discrepancies are found, then adjustments can be done in NetSuite using an inventory adjustment transaction

- Performing a year-end financial ‘post-mortem’ helps in detecting errors or unfinished transactions. It is considered good practice to look back into Accounts Receivable and Accounts Payable registers to check for unpaid bills or unreceived payments

- The chart of accounts in NetSuite can be verified by a year-end bank reconciliation. Discrepancies found in the process can be corrected before closing

Optimizing search and reporting performance:

- NetSuite provides powerful search capabilities that enable retrieval of the precise information needed, from a potentially vast amount of stored data. However, going through a large number of stored records can slow the retrieval of search results

- NetSuite provides users with conditions, which is one of the most resource-intensive search mechanisms. Try to use conditions wherever possible to improve search performance

- NetSuite offers the option of scheduling saved searches and having results emailed to the recipients you choose, so you do not have to stop your work to wait for exceptionally long searches. Scheduling these saved searches improves performance

- Long reports can takes a while to display results, so these can be schedules. On the Schedule Report page you can select recipients, enter a message, and select attachments to include with the emailed report. You can then use options on the Recurrence tab to define how often you want this report emailed to the recipients

Our team of experts can help with your custom NetSuite requirements. Find out more with a demo.